9 Crown Row, Bracknell, Berkshire, RG12 0TH

Lettings Valuer

Liam attended school locally in Ascot and began his career in estate agency aged 18 in the Bracknell area. He has gone on to gain experience within the Maidenhead, Reading and Wokingham markets too. Building relationships is what Liam enjoys the most in his role, which gives him the opportunity to meet and help all kinds of people. Away from work, Liam enjoys playing football throughout the week and for a local Bracknell team on a Sunday (some say the next Sunday League Pirlo).

The best piece of advice I’ve ever been given is…

The way to get started is to quit talking and start doing.

Top of my bucket list is…

To travel around America and Australia.

On Sunday mornings, you can usually find me…

On a football pitch in all weathers – potentially a little jaded from the night before.

My guilty pleasures are…

Watching Super Sunday and the F1 whilst devouring a takeaway. Highly recommended.

The thing I like best about my job…

Helping and advising landlords on how to make the process of letting their property as stress-free as possible, and assuring tenants throughout the process so that it becomes an enjoyable and exciting experience.

The person I’d most like to go for a drink with is…

Sir Alex Ferguson.

2 Sep 2019

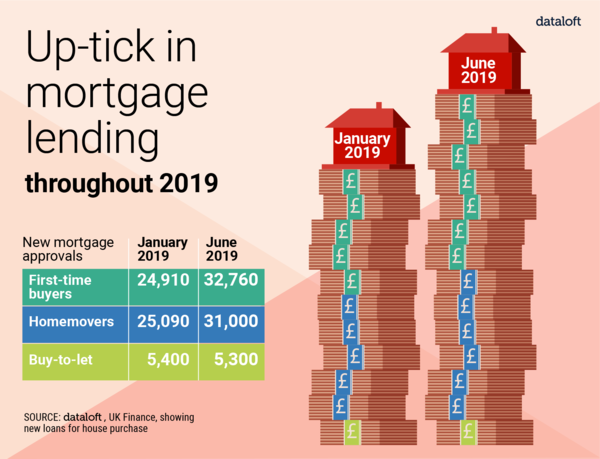

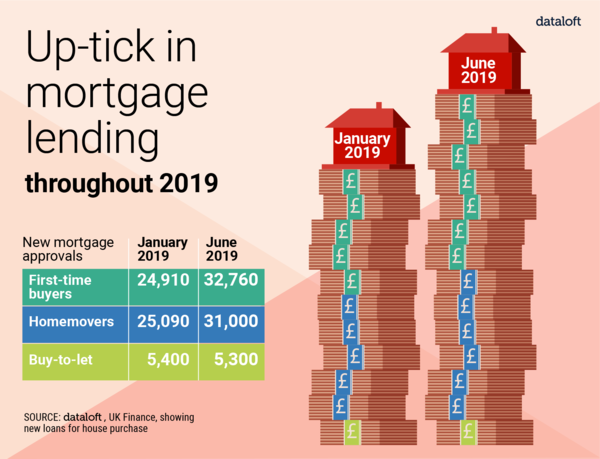

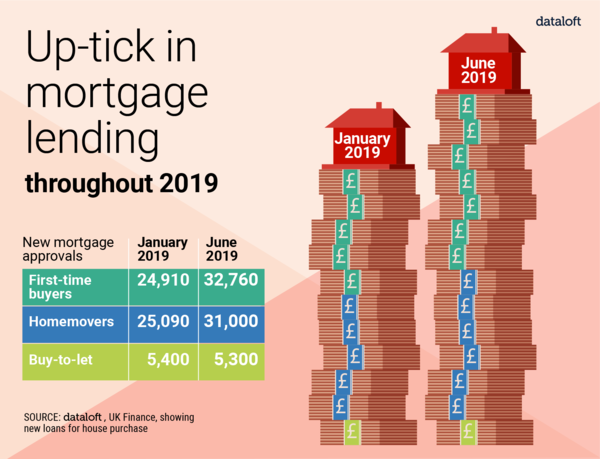

Click here for free independent mortgage advice with Mortgage Required.

Get in touch